Paycheck Protection Program (PPP) Fraud

Paycheck Protection Program (PPP) Fraud cases have been on the rise since its inception as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

As investigations into fraudulent claims continue to unfold, individuals charged with PPP fraud need the help of skilled criminal defense attorneys to protect their rights and get a fair trial.

Defending PPP Fraud

If someone is found guilty of either of these criminal activities, he or she can face severe penalties of up to 30 years in prison and up to $1,000,000 in fines. This makes it imperative to have the best defense possible to mitigate these penalties.

Common defense strategies include:

Challenging the Government’s Evidence

We may argue that there is insufficient evidence to establish a client’s guilt beyond a reasonable doubt or point out inconsistencies in the paperwork provided by the government.

By scrutinizing every piece of evidence, including financial records, bank statements, and application materials, defendants aim to create doubts about their alleged wrongdoing before a judge or jury.

Lack of Intent or Knowledge

Many small business owners were thrust into unprecedented circumstances with the economic fallout caused by the pandemic, and they were desperate to save their enterprises from sinking. In many cases, these entrepreneurs had limited knowledge about government loan programs and our Small business PPP fraud defense lawyer will gather evidence showing how relying on consultants or advisors may have misled them unintentionally.

Further, to be eligible for forgiveness, applicants needed to navigate a maze of guidelines and regulations that even experienced professionals found confusing at times. For small business owners already struggling to stay afloat, dedicating extensive time and resources to fully comprehend every intricate detail may have been an unfeasible task.

In some instances, mistakes made during this arduous process could have inadvertently resulted in fraudulent claims without the applicant’s awareness and our small business PPP fraud defense lawyer will hard to bring these circumstances to light.

Good Faith Defense

If a client believes that they applied for and used PPP loan funds for a legitimate reason, we can also emphasize their sincere belief that they were eligible for PPP loans despite any irregularities discovered later on.

Our PPP fraud defense lawyer can argue that you relied on advice from professionals, such as accountants or other legal professionals, who assured them they met all necessary criteria and requirements for obtaining these funds.

Related: SBA EIBL Loan Fraud

An SBA EIDL (Economic Injury Disaster Loan) is a loan program offered by the U.S. Small Business Administration (SBA) to provide financial assistance to businesses affected by disasters or economic downturns.

The consequences of an SBA EIDL loan fraud conviction can be severe, ranging from hefty fines to imprisonment. It is essential for individuals accused of these crimes to consult experienced attorneys specializing in white-collar defense like our team at Stechschulte Nell Law.

We have an in-depth understanding of complicated financial offenses and our Small business PPP fraud defense lawyer can help the accused work through voluminous evidence and intricacies associated with SBA or PPP loans.

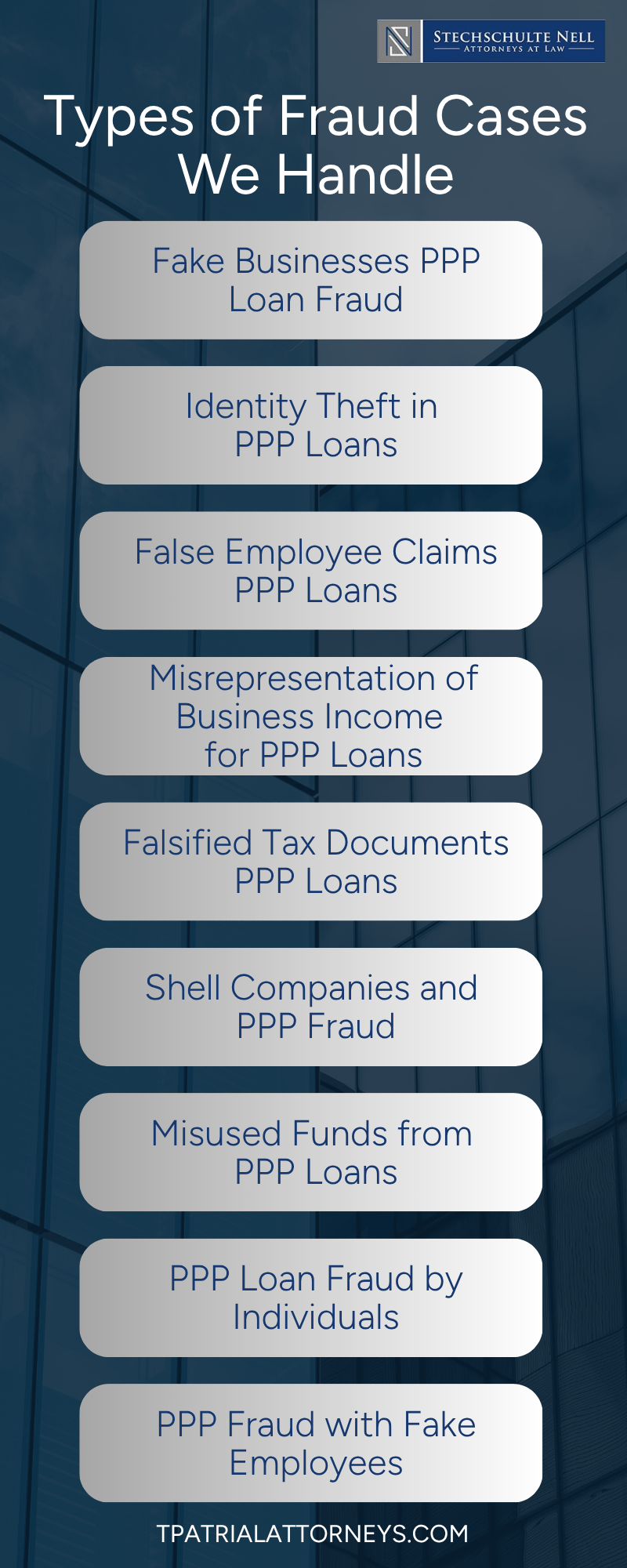

Types of Fraud Cases We Handle

- Fake Businesses PPP Loan Fraud: Creating a completely fake or non-existent business just to apply for and receive a Paycheck Protection Program (PPP) loan.

- Identity Theft in PPP Loans: Using someone else’s personal or business information—without their permission—to fraudulently apply for a PPP loan.

- False Employee Claims PPP Loans: Lying about how many employees a business has (usually claiming more than it really does) in order to qualify for a bigger PPP loan.

- Misrepresentation of Business Income for PPP Loans: Inflating or lying about a business’s revenue or income on PPP loan applications to receive more money than the business would normally qualify for.

- Falsified Tax Documents PPP Loans: Submitting fake or altered tax documents (like IRS forms) to make a business seem eligible for a larger PPP loan.

- Shell Companies and PPP Fraud: Setting up a “shell company” — a company that exists only on paper with no real operations — to fraudulently obtain a PPP loan.

- Misused Funds from PPP Loans: Spending PPP loan money on things it wasn’t intended for (like luxury goods, personal vacations, or gambling) instead of payroll, rent, or utilities as required.

- PPP Loan Fraud by Individuals: When an individual (not necessarily through a real or fake business) personally lies, cheats, or manipulates the system to get PPP loan money they don’t qualify for.

- PPP Fraud with Fake Employees: Claiming to have employees that don’t actually exist to inflate payroll costs and get a larger PPP loan amount.

Hire an Attorney

It is vital to remember that each case can have unique circumstances, demanding tailored defense strategies. Seeking legal advice from an experienced attorney who specializes in white-collar crime can help individuals navigate through these complex allegations and build strong defenses against PPP loan fraud charges.

If you or someone you know has been charged with PPP loan fraud, contact us immediately. This is a serious matter and you need our certified criminal defense attorney who practices in the federal court system to best represent your interests.

Defining PPP Loan Fraud

The Paycheck Protection Program (PPP) was created as a lifeline for small businesses during the COVID-19 pandemic. Designed to help businesses retain employees and cover essential expenses, it quickly became an effective tool in keeping the economy afloat. However, the sheer volume of loans and speed at which they were disbursed created opportunities for fraudulent activity. As a result, PPP loan fraud has become a serious issue, with severe consequences for those caught intentionally misrepresenting their financial information or misusing funds.

If you are facing charges, our Federal PPP loan fraud lawyer at Stechschulte Nell can explain your rights and legal options. Attorney Ben Stechschulte is a board certified criminal defense attorney, a distinction only 2% of all Florida attorneys have achieved. Don’t face the Florida justice system alone. Instead, lean on our skilled criminal defense practice.

Elements of the PPP Loan Program

The PPP Loan Program was launched to help businesses maintain payroll and cover other operational expenses during the economic downturn. Businesses could apply for loans through approved lenders, and the loans could be forgiven if they were used for qualifying expenses, primarily payroll. The goal was to provide quick relief and prevent mass layoffs, but the rapid rollout and high demand meant that many businesses were eager to apply, sometimes overlooking the details of the application process.

The loan terms were set by the U.S. Small Business Administration (SBA), which required applicants to submit financial documents to prove their eligibility. However, the program’s broad reach and relatively simple application process made it vulnerable to exploitation. Some individuals falsified documents, inflated numbers, or misused the funds, leading to widespread instances of fraud.

PPP Loan Eligibility Requirements

To qualify for a PPP loan, businesses had to meet certain criteria. They had to have 500 or fewer employees and demonstrate that their operations had been disrupted by the pandemic. Applicants also needed to prove they were in business as of February 15, 2020, and that the loan would be used primarily for payroll, though other expenses like rent and utilities were also eligible.

The application process required submitting financial documents such as tax returns, payroll records, and bank statements. In many cases, businesses submitted inaccurate information either unintentionally or to increase their loan amounts. However, intentional fraud is a significant problem, with some applicants falsifying documents or inflating payroll figures to qualify for larger loans. The improper use of funds, such as spending the loan on personal expenses rather than business operations, also led to accusations of fraud.

Consequences of PPP Loan Fraud

The consequences of PPP loan fraud are severe. Those convicted of falsifying information or misusing loan funds can face both criminal and civil penalties. PPP fraud and other federal crimes, including wire fraud or bank fraud, can result in substantial prison sentences—up to 30 years in some cases. Fines for PPP loan fraud can range from $250,000 for individuals to up to $500,000 for businesses, depending on the circumstances.

Beyond legal penalties, fraud convictions can damage a business’s reputation irreparably. Clients, customers, and partners may lose trust in a company involved in fraudulent activity, making it difficult to recover financially. In addition, businesses may be excluded from future federal assistance programs, limiting their ability to access future relief. The personal and professional ramifications of a fraud conviction can be far-reaching, even long after the legal penalties are served.

Given the seriousness of these consequences, anyone accused of PPP loan fraud should seek legal counsel immediately. Our skilled attorney can assess the details of the case and create a strategy for your Florida PPP loan fraud defense, whether the fraud was intentional or the result of a misunderstanding. The stakes are high, and the earlier you get help, the better your chances of minimizing the impact on your life and business.

Why Legal Representation Matters in PPP Loan Fraud Cases

PPP loan fraud is not something to take lightly. With both criminal and civil penalties on the line, anyone facing allegations of fraud must understand the seriousness of the situation. Whether the fraud was committed knowingly or unintentionally, working with our experienced Federal PPP loan fraud defense lawyer is essential. A strong legal defense could mean the difference between substantial penalties and a favorable outcome. If you’re facing charges or investigations related to PPP loan fraud, don’t wait—take action to protect your future today by calling Stechschulte Nell to schedule a case evaluation. Choose the legal team of powerful allies and advocates. We know the law and we are prepared to fight for you.

4 Mistakes to Avoid When Dealing with PPP Loan Fraud Claims

Facing accusations of PPP loan fraud can be overwhelming. The government is cracking down on fraud, and the consequences of a conviction are serious. If you’re dealing with PPP loan fraud claims, it’s vital to handle the situation carefully. Even a small mistake can make things worse. Speak with our responding to PPP loan fraud claims lawyer for help managing the legal process. Your freedom and future are our main motivation. The team at Stechschulte Nell will help you avoid common mistakes when responding to PPP loan fraud allegations.

1. Ignoring the Situation or Delaying Action

One of the biggest mistakes you can make when facing PPP loan fraud claims is ignoring the situation. Many people believe that if they ignore the allegations, they will go away, or that the authorities will lose interest. Unfortunately, that’s not how it works. The government is actively investigating PPP fraud, and failure to respond can lead to more severe consequences.

Delaying action only increases the risk of facing criminal charges or missing out on opportunities to defend yourself. If you’ve received a notice of investigation or a request for more information, addressing it promptly is critical. Our lawyer who is experienced in PPP loan fraud cases can guide you through the process, helping you understand your rights and obligations.

2. Attempting to Handle the Case Without Legal Help

Responding to PPP loan fraud claims without professional legal help is a mistake that can seriously hurt your case. Many people attempt to go it alone, thinking they can handle the situation independently. However, dealing with fraud allegations requires knowledge of both criminal law and the specifics of the PPP loan program.

Our experienced Paycheck Protection Program fraud defense lawyer understands the defense strategies that could work best for your case. We can help you gather evidence, challenge incorrect claims, and negotiate with authorities. Without legal guidance, you might unknowingly make statements that hint at an acceptance of responsibility causing harm to your defense or missed opportunities to reduce penalties. Don’t make the mistake of handling such a serious issue without the right support.

3. Providing Incomplete or Inaccurate Information

Another mistake people make when dealing with PPP loan fraud claims is providing incomplete or inaccurate information. Whether it’s a misunderstanding of the program’s rules or an attempt to cover up mistakes, offering misleading information to investigators can make things much worse. Even if you believe the information is minor, it could lead to charges of obstruction or lying to authorities, adding additional legal trouble on top of the fraud allegations.

When responding to claims, make sure all the information you provide is thorough and accurate. If you’re unsure about something, consult with our attorney before submitting any documents or making statements. Our PPP fraud defense lawyer will help you make certain that everything is correct and aligned with the facts of your case.

4. Failing to Document Everything

In legal cases, documentation is key. Failing to keep thorough records or ignoring essential documents related to your PPP loan application and use of funds can hurt your defense. If you’re accused of fraud, you’ll need evidence to back up your claims, whether it’s to prove you used the funds appropriately or to demonstrate that any discrepancies were honest mistakes.

It’s important to keep copies of all the documents related to your loan application, disbursement, and how the funds were spent. This includes payroll records, tax returns, bank statements, and any communication you had with your lender or the government. Failing to document everything properly could lead to a weaker defense. Our lawyer can help you organize and present this information in the most effective way.

Take Control of Your Defense Against PPP Loan Fraud Claims

Dealing with PPP loan fraud claims is a serious matter that should not be taken lightly. Avoiding these common mistakes can help protect your rights and improve the chances of a favorable outcome. If you’re facing allegations, don’t hesitate to seek legal help. Our experienced responding to PPP loan fraud claims lawyer will work with you every step of the way to make sure that you respond effectively and minimize the consequences. The sooner you get professional guidance, the better your chances of protecting your future.

You don’t have to face the justice system alone. Don’t risk your freedom. Call our office today to schedule a free consultation.

7 Steps to Take to Build Your Defense Against PPP Loan Fraud Claims

If you’re facing accusations of PPP loan fraud, it’s imperative to understand how serious the situation can be. The penalties for fraud can be severe, including fines and prison time. However, with the right approach and guidance from our defense options for PPP loan fraud lawyer, you can build a strong defense. Our legal team at Stechschulte Nell recommends considering taking these essential steps when preparing your defense against PPP loan fraud claims.

1. Consult Our Lawyer Who Specializes in PPP Loan Fraud

The first and most important step when facing any fraud allegations is to consult with our lawyer who has experience handling PPP loan fraud cases. Our skilled defense attorney understands the details of the program and the legal intricacies involved. We can assess your situation and advise you on the best course of action. PPP loan fraud cases are complicated, and having our lawyer by your side from the beginning can make all the difference in the outcome.

Our lawyer will also help you understand the charges against you, what evidence the government may have, and what your options are for fighting the accusations. Attorney Amy Nell has over a decade of experience in fraud and criminal defense law and diligently fights for her clients’ rights and freedoms. Don’t wait to get the help you need to defend your case.

2. Gather All Relevant Documentation

Your defense will largely depend on the evidence you can present. One of the first things our lawyer will want is all relevant documentation related to your PPP loan application and use of the funds. This includes:

- Payroll records

- Bank statements

- Tax returns

- Loan application forms

- Correspondence with lenders or the SBA

Be thorough and provide all documentation that supports your case. Missing or incomplete records can weaken your defense. Our Paycheck Protection Program fraud defense attorney can help organize this information and identify what’s most important for your case.

3. Review Your Loan Application for Errors or Misunderstandings

If your loan application was submitted with incorrect information—whether accidental or unintentional—it’s essential to identify and address it as soon as possible. Some mistakes may be honest errors, like incorrectly reporting payroll figures or misunderstanding the program’s requirements.

Our PPP fraud defense lawyer can help you determine whether these errors can be explained or corrected without facing criminal penalties. If the mistakes were unintentional, they may be a part of your defense strategy, showing that you did not have fraudulent intent. However, it’s important to be upfront and transparent about these issues with our attorney.

4. Assess the Intent Behind the Loan Application

In many cases, PPP loan fraud charges rely on proving that the applicant intentionally misrepresented information or used the funds for improper purposes. One key aspect of your defense will be showing your intent when applying for the loan and using the funds.

If you genuinely believed you were eligible for the loan and used the funds appropriately, our lawyer can work to demonstrate this to the authorities. We may also argue that any discrepancies were the result of a misunderstanding, not deliberate deception. In cases where misused funds are involved, showing that the funds were spent on other legitimate business expenses, rather than personal expenses, could also help support your defense.

5. Cooperate with the Investigation (When Advised)

Cooperating with an investigation can sometimes benefit your defense, but only if it’s done carefully and under the guidance of our lawyer. Our attorney can advise you on what to say and what to avoid during any interviews or discussions with investigators. Making the wrong statement or volunteering unnecessary information could harm your case, so it’s important to have legal counsel every step of the way.

By cooperating in a limited and strategic way, you may be able to clarify your position and avoid the escalation of the case. Our lawyer can help you manage this process to minimize any risk.

6. Consider Possible Defenses

There are several defenses our lawyer might consider based on the details of your case. Common defenses in PPP loan fraud cases include:

- Lack of intent: You did not intentionally mislead anyone, and any errors were honest mistakes.

- Ineligibility: You were eligible for the loan but were mistakenly classified as ineligible or made an error in your application.

- Misuse of funds defense: You used the loan for business expenses but may have misunderstood the rules around qualifying uses of the funds.

Our lawyer will assess the facts of your case and determine which defense strategy could be most effective. We will also work to gather any supporting evidence to bolster your argument so you may be able to avoid federal sentencing and other consequences.

7. Prepare for Possible Negotiation or Settlement

In some cases, PPP loan fraud cases can be resolved without going to trial. Our attorney may work with the government to negotiate a settlement or plea agreement. This could include reduced charges, lower fines, or other favorable terms.

While this may not be the right option for every case, it’s something our lawyer can discuss with you if it’s a possibility. If you decide to go this route, it’s important to fully understand the terms of any agreement before agreeing to a federal plea bargain or settlement.

The Path to a Strong Defense

Building a strong defense against PPP loan fraud claims is a multi-step process that requires careful attention to detail, documentation, and legal expertise. By following these steps and working closely with our experienced defense options for PPP loan fraud lawyer lawyer, you can improve your chances of a favorable outcome. The earlier you seek legal advice, the better equipped you will be to handle the investigation and protect your rights. If you or a loved one has been accused of PPP fraud, call us right away—don’t risk your freedom and future! Get started with a free case review today.

Florida PPP Loan Fraud Defense Infographic

Florida PPP Loan Fraud FAQ

The Paycheck Protection Program (PPP) was a lifeline for many businesses during the COVID-19 pandemic. Yet, with its rapid implementation came widespread allegations of fraud. For those facing accusations, the stakes couldn’t be higher. As Florida PPP loan fraud cases increase, we want to clarify what’s at risk and how individuals can protect their rights.

At Stechschulte Nell, we’ve seen firsthand how these accusations can affect lives. As a Tampa criminal defense lawyer, Ben Stechschulte—a former criminal prosecutor and board-certified defense attorney—brings unparalleled insight to these cases. Let’s break down some of the most pressing questions about PPP loan fraud.

Who Can Be Accused Of PPP Loan Fraud?

PPP loan fraud allegations can impact business owners, employees, and even consultants. The program was designed to provide emergency funding to keep businesses afloat, but mistakes in applications or misuse of funds can trigger criminal investigations.

For example, if someone claimed inflated payroll expenses or submitted falsified documents to secure higher loan amounts, federal agencies like the Department of Justice (DOJ) or Small Business Administration (SBA) might investigate. Even an honest mistake can look like fraud under scrutiny, which is why having strong legal representation matters.

What Constitutes PPP Loan Fraud?

PPP loan fraud encompasses several types of misconduct:

- False Claims: Submitting inaccurate information on loan applications.

- Misuse of Funds: Using loan money for unapproved expenses, such as personal purchases.

- Multiple Applications: Applying for multiple PPP loans for the same business through different financial institutions.

- Identity Theft: Using stolen identities to apply for loans.

Each of these acts can carry severe PPP loan fraud penalties, including imprisonment and hefty fines. Federal investigators don’t take these cases lightly, often using detailed audits to uncover discrepancies.

Why Are Florida Cases Increasing?

Florida has seen a rise in PPP loan fraud cases, partly because of the state’s high number of small businesses. In the rush to secure funding, many entrepreneurs unknowingly made errors on their applications. Others were misled by third-party advisors promising quick approvals without emphasizing compliance.

Unfortunately, the government often treats all irregularities as intentional acts of fraud. This is where our Paycheck Protection Program fraud defense lawyer comes in—to help distinguish between deliberate misconduct and honest mistakes.

How Do We Defend Against PPP Loan Fraud Charges?

When accusations arise, the key is building a strong defense. At Stechschulte Nell, we focus on several strategies:

- Examining Evidence: We meticulously analyze financial records, loan applications, and communication with advisors. Often, inconsistencies in the government’s evidence can create reasonable doubt.

- Proving Lack of Intent: Many clients genuinely believed they were following program guidelines. Demonstrating this good faith can be a powerful defense.

- Highlighting External Misguidance: If accountants or consultants provided misleading advice, it’s essential to show how this contributed to any errors.

What Are The Consequences Of A Conviction?

A conviction for PPP loan fraud can result in up to 30 years in prison and fines reaching $1 million. Beyond legal penalties, there’s reputational damage and financial hardship. That’s why it’s critical to act swiftly and partner with our defense team that understands both the legal landscape and your personal story.

If you’re facing accusations of Florida PPP loan fraud, don’t wait to take action. The sooner we begin preparing your defense, the better your chances of a favorable outcome. At Stechschulte Nell, we combine professional skill with personal commitment so that you receive the best possible representation.

Call us today for a free consultation with our PPP fraud defense lawyer. Let us help you stop a bad situation from derailing your life. Your future deserves more than fear and uncertainty—it deserves a strong defense.

PPP Loan Fraud Glossary

PPP loan fraud investigations are increasing in Florida and across the United States. As federal agencies continue to target those accused of misusing pandemic relief funds, individuals and business owners need to understand the legal terms and procedures that apply to their situation. Our Florida PPP loan fraud defense lawyer team represents clients facing accusations under the CARES Act and other federal laws. Below is a glossary of key legal terms and phrases commonly used in PPP loan fraud cases. Each entry is explained in plain language to help clarify the legal issues that may arise during an investigation or trial.

Forgiveness Eligibility Criteria

Loan forgiveness in the Paycheck Protection Program depended on whether borrowers used the funds for approved purposes within a specified period. These purposes primarily included payroll expenses but could also cover utilities, rent, and mortgage interest. To apply for forgiveness, borrowers had to provide detailed documentation showing that at least 60% of the funds were used on payroll and the remainder on other qualified expenses.

Borrowers who failed to meet the requirements faced full or partial loan repayment, and in some cases, additional scrutiny that led to criminal allegations. In PPP fraud defense cases, a common strategy involves showing that the client met—or reasonably believed they met—these criteria based on information available at the time.

Material Misrepresentation

A material misrepresentation is a false statement or omission that influences a lender’s or agency’s decision. In PPP loan cases, this may involve overstating the number of employees, inflating payroll figures, or misreporting revenue. Whether the misrepresentation was intentional or the result of a misunderstanding, prosecutors often treat these actions seriously.

We look closely at whether our client’s representations were based on information they believed to be accurate at the time. If discrepancies can be attributed to reliance on third-party advisors or misunderstanding complicated guidance, those facts may support a strong defense.

Lack Of Criminal Intent

Criminal intent, or “mens rea,” is required for a fraud conviction. In PPP fraud cases, prosecutors must prove that the accused knowingly and willfully submitted false information or misused funds. Many small business owners applied for relief under intense pressure and may not have fully understood the guidelines or legal implications.

We often present evidence showing that clients acted in good faith, relied on financial professionals, or made errors without any intention to deceive. Demonstrating the absence of criminal intent can result in reduced penalties or dismissal of charges altogether.

Use Of Shell Companies

A shell company is a business entity with no active operations or significant assets, often created to conceal ownership or financial transactions. In PPP loan fraud cases, these entities are sometimes used to apply for loans without legitimate business activity. Prosecutors view this as a clear red flag and pursue charges when there’s evidence that a shell company was created solely to obtain funds.

In defending clients accused of this tactic, we investigate the timeline and purpose of the company’s formation. If the business had a legitimate intent or purpose at the time it was established, or if paperwork was prepared by others, this information could be critical in building a defense.

SBA Loan Program Compliance

Compliance with SBA (Small Business Administration) program rules was essential for legitimate PPP loan recipients. The SBA outlined specific qualifications and procedures for applying, using, and documenting loan funds. Violating these guidelines—intentionally or unintentionally—can lead to fraud allegations. Common issues include misuse of loan proceeds, failure to document expenses, and misreporting business activity.

Our team reviews every aspect of our client’s loan process to evaluate whether noncompliance occurred, and if so, whether it was due to confusion, reliance on bad advice, or honest mistakes. These details often shape how we respond to investigative inquiries and legal filings.

Facing federal fraud charges is overwhelming, but you don’t have to go through it alone. The team at Stechschulte Nell has experience with white-collar defense and PPP loan fraud cases in Florida. If you’ve been contacted by authorities or charged with a federal offense, call us today to review your case and protect your legal rights.